13.5 million people in the UK live in poverty, with over 1 million without access to bank accounts (4% of Britain’s population) and a further 8 million (15%) underbanked – that’s a lot of people who have to find a way to survive in the 6th richest country in the world.

Recognising this reality, Women Advancing Microfinance UK (WAM UK) are proud to co-host Bringing Grameen to the UK: An Audience with Professor Muhammad Yunus to present the new Grameen UK initiative to provide microcredit to address entrenched poverty and multi-generation welfare dependency in celebration of International Women’s Day, on 8th March 2012, at Clifford Chance, 10 Upper Bank Street, London, E14 5JJ from 11.15am – 1.30pm.

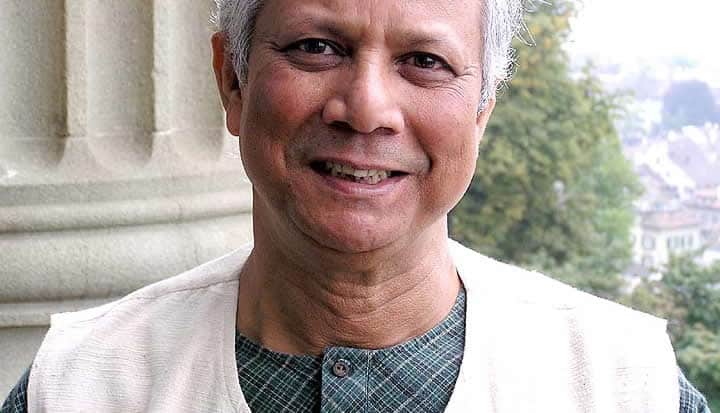

Professor Yunus founded the Grameen Bank in 1976 to break the cycle of poverty and reliance on exploitative money lenders in Bangladesh. He started his microcredit experiment by lending the equivalent of $26 to a group of 42 workers – that’s roughly 62 cents each – so that they could buy material to make chairs and pots for sale. This initial pilot group of committed women sold their work, repaid their tiny loans and, in doing so, paved the way for many others.

Microfinance has since scaled and travelled. By 2011, 20 million borrowers around the world including the US, benefited from Grameen’s services and over $20.5bn of loans were made globally. Today American women can access loans that formal financial services are unwilling to make, because they deem them too risky and small, to start up their own businesses. Sabina of Queen’s, New York, took out her first loan of $1,500 two years ago to buy plants; four loans later she has her own storefront supplying flowers for all occasions: “In this life, anything is possible with hard work and perseverance”, she beams, proud of her achievements.

Inspired by entrepreneurs like Sabina, WAM UK was founded in February 2011 by a group of like-minded women dedicated to supporting financial inclusion and microfinance. As a small advocacy group, WAM UK knew there was much to be done to promote financial inclusion in the UK, but little did we know that in our first year of existence we would co-host the introduction of Grameen into the UK. We have secured limited spaces for our members to what promises to be a fantastic event with Professor Yunus to introduce a game-changer in the state of UK financial inclusion. The talk will also be followed by a book signing with the Nobel Peace Prize winner from 1.30 – 2.00pm.

So, please come join us on the 8th March and learn about how we can tackle financial exclusion in the UK.

WAM UK is a unique networking association and one of 14 chapters of WAM International. To attend the event with Professor Yunus on the 8th March please become a member here and then RSVP to wa***********@gm***.com" target="_blank">wa***********@gm***.com . Please note WAM UK spaces are open to our members only.

One Response

Prof. Yunus demonstrated the compassion spoken often in Buddhism, the suggestiion of Jesus in Matthew 25: 31 – 41 and the directive in Islam as well as humanitarian ideals everywhere. Doing something, anything even the small things to build up on like the recipients of the small loans do. Thank you Prof. Yunus for your vision and inspiration.