Affordability is at the core of much of our work as impact investors – from affordable electricity to housing, food, healthcare, education and many more. Yet ask someone to define what it means, and you may be met with little more than a blank stare.

We recently conducted a straw poll of 20 impact investment colleagues – asking them to define affordability, and received a variety of responses, including: “The ability to buy something and keep a reasonable life quality”. “The value of goods relative to the average purchasing power of individuals / families”. “When a large proportion of society (e.g. at least the top of the bottom quartile) can purchase a product / service.”

These responses underline the findings of Kessides et al (World Bank) – that although there is intuitive agreement about affordability, it is practically understood in different ways.

Without a shared understanding of affordability – however – we risk conceptualising it too narrowly, and missing innovative opportunities on two fronts:

First, as impact investors (like CDC), many of whom make investment decisions based (at least in part) on whether we are improving the affordability of products and services for poorer segments of society.

Second, as businesses (especially those operating in low income markets) – for whom it drives the adoption of products and services by consumers, as well as shaping their development, and defining how they are distributed.

A working definition

Without a universally agreed concept, we propose a working definition based on evidence from our investee businesses, colleagues at the World Bank, Acumen, Bain & Co., and others – outlined in the model below. We define affordability as the ability to pay, which is, in itself, made up of two components: (1) buying power, and (2) economic cost – with six further dimensions beneath them.

Our model shows that affordability is not just solved by making cheaper products or increasing household incomes it is made up of different market forces.

Understanding this – that affordability is comprised of a variety of different factors that businesses can play a role in addressing – provides opportunities for businesses in creating innovative products and services. We are already seeing ways our investee companies are addressing the six factors here from financing to cost of access.

For example, East African off-grid solar company M-KOPA has enhanced consumers buying power by providing pay-as-you-go financing for its products. Meanwhile, pan-African higher education provider UNICAF has recognised that the cost of studying is prohibitively high for many and therefore part-time degrees are popular. In response it provides low-cost online degree courses that are accredited by an international university and that can be undertaken whilst working. This reduces the high opportunity cost of studying and provides access to higher education for a new and previously underserved market segment.

An understanding of affordability is crucial to capture ‘hidden’ market opportunities

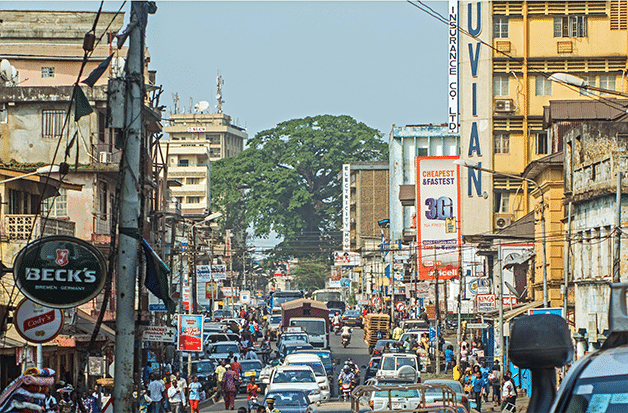

Whilst there are many more examples of companies innovating to reach poorer customers, it is understandable to see why most business models that are popular with investors still focus on the growing middle classes. Many low-income households are situated in rural areas with low population density making them hard (and expensive) to reach. Similarly, in urban areas, low income groups over-proportionately live in low cost areas – likely to be the least well served by the formal economy. A combination of limited economies of scale (due to geographical dispersion) coupled with challenges in local transport and logistics means that important products, such as basic foodstuffs, are expensive to move to the populations that need them most and therefore many items are simply unavailable or unaffordable for low-income customers.

Despite these factors, we estimate that the bottom 40 per cent of households in Sub-Saharan Africa alone represent more than $100 billion in buying power. Given that these households are typically underserved by formal providers relative to the wider population, they present a compelling opportunity – from a commercial and developmental perspective.

This is why understanding affordability, which is arguably the most important ingredient to successfully market towards base of pyramid customers is so crucial.

The food sector as an example where affordability is a key element to success

Identifying opportunities to reach poorer communities typically requires detailed local knowledge, so it can be challenging to focus on single products or services that will have universal appeal. However, some themes do transcend national borders – chief among these being the prominence of food spending.

Our analysis shows that food spending is, by far, the ‘biggest show in town’ for household budgets – accounting for almost half of all household spending in many African countries – and presenting the largest strain on households in the poorest segments of society.

Making food cheaper and reducing associated costs of access therefore presents a huge opportunity to create budgetary space at a household level – freeing up buying power to be spent on more food, more nutritious food, or elsewhere entirely. This extra buying power is most likely to put towards products or services with high income elasticities. Our own analysis, combined with that from the African Development Bank, suggests that savings are likely to be directed towards: transport, communications, recreation, electricity, education, healthcare and water. Simply speaking, money saved on food spending increases overall household budgets – and likely increase spending on products and services that have a positive overall impact on people and communities.

Therefore, improving the affordability of food, is about far more than just food, it is about everything that households have to and aspire to buy. The stubborn nature of poverty means that the need for affordable access to food will remain a priority for decades to come.

Understanding – and defining – how we can do it will be a crucial question for businesses and investors alike.