Work is often lauded as the most important route out of poverty. There is little doubt that work can and even should provide a way out, but for hundreds of millions of people, this is simply not the case.

In the lower-income countries that make the biggest contributions to global supply chains, large numbers of workers are living below the poverty line: for example 58% of workers in Mozambique, 37% in India, and 33% in Mexico are in working poverty.

And in wealthier economies, the problem persists. In the UK, almost 1 in 5 children from households where all adults work, nevertheless live in poverty. In the USA, around one-third of workers earn less than $15 per hour, rising to 50% for working women of colour. And in Europe, almost one out of ten workers is at risk of in-work poverty.

The case for living wages

In the face of this unconscionable situation, there is something that businesses can do: paying a living wage in core operations and the value chain will enable workers to earn enough income to support their family’s basic needs – for example, food and water, housing, clothing, education and healthcare – and allows them to put aside savings and to cope with emergencies.

Few could argue against the moral case, but we are still a long way from businesses embracing living wages. This lack of inaction is, in part, due to fears that paying living wages could damage the bottom line. This report changes this prevailing narrative by highlighting how living wages can offer a host of benefits to businesses, and therefore should be seen as an investment in business success.

Published jointly by Business Fights Poverty, University of Cambridge Institute for Sustainability Leadership and Shift, with support from Unilever, this new report draws from existing literature, over thirty interviews and three group discussions with leading businesses, investors, academics and organisations who support fairer wages.

The report shows that paying living wages pays back for business, strengthening business performance, resilience and stability, and creating measurable social impact. What is more, living wages are integral to companies’ responsibility to protect human rights.

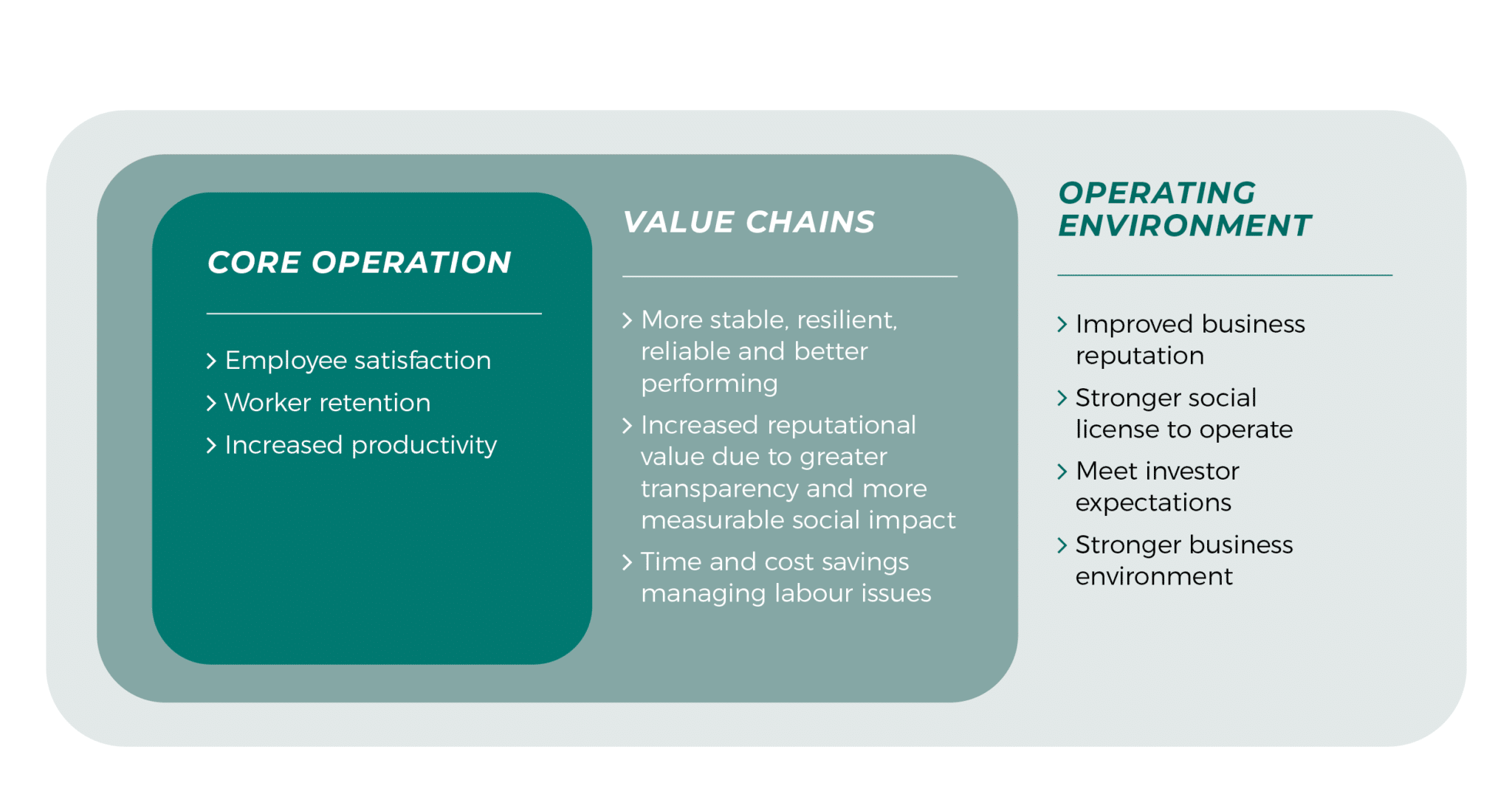

In particular, the report shows how paying living wages positively impacts business at three levels:

1 Enhancing business performance in core operations via lower staff turnover, which reduces recruitment and training costs; a more motivated and productive workforce, by improving morale and commitment; greater employee wellbeing and satisfaction.

PayPal increased the disposable income of the lowest paid employees to 16 percent of the average employee’s pay (from 4-6 percent at market wage rates). Revenue grew by 15 percent and profitability by 28 percent in non-GAAP earnings in 2019 compared to 2018. The company projected similar growth from 2020 to 2021. PayPal’s CEO maintains that the increase in wages is a key driving factor in this success.

2 Strengthening value chain stability, performance, and resilience through investments in long-term supplier relationships and responsible procurement practices. Living wages offer a measurable pathway to improve supply chain performance, transparency and social impact, while reducing the costs of managing labour issues.

Inditex is investing to drive progress towards living wages by transforming its commercial relationship with suppliers. Their four-pillar plan combines:

- Collective bargaining agreements

- Responsible purchasing practices

- Improving supplier production processes

- Improving management systems to ensure greater efficiency, traceability, and transparency in payments to workers.

3 Helping create a supportive and stable operating environment. This is felt in reputational gains with consumers; positive multiplier effects in local economies through boosting incomes and likely demand for goods and services; satisfying investor interest in mitigating the systemic risk of inequality.

“Covid has brought quite a few investors to think differently about these issues – realising that workers going from paycheck to paycheck is not sustainable. Having a workforce that is not resilient to shocks has resonated with investors, seeing the impact that it had on the economy at large.”

Nabylah Abo Dehman, Head of Stewardship, Social Issues and Human Rights, PRI

Alongside this key finding, here are three more important insights from the report:

Investors are making the link between payment of living wages and mitigation of risk.

As COVID-19 has demonstrated, when workers in a value chain live in poverty, the resilience of the value chain itself suffers. Living wages can mitigate risks for individual companies, in terms of value chain resilience, reputation, legal and regulatory risk. For universal investors, living wages also mitigate systemic risks of poverty and inequality.

Living wages are a clear, measurable demonstration of social impact. Consequently, living wages are becoming more prominent in sustainability indices such as the Dow Jones Sustainability Index. In 2021, S&P Global introduced a living wage criterion into their Corporate Sustainability Assessment, which is compulsory for companies in industries such as food retail and products, mining, construction, electronics and textiles.

Several of our interviewees cited this rising investor interest in living wages as a key driver of their company’s commitment to living wages, alongside the contribution that living wages can make to delivering on corporate human rights obligations. As explained below:

“Failure to enforce appropriate labor standards, including the payment of a living wage, can lead to severe risks for companies and investors. Yet when living wages are being paid, a large spectrum of human rights are being supported whilst positively contributing to achieve the Sustainable Development Goals.”

Carola van Lamoen, Head of Sustainable Investing, Robeco

We need sector-level and cross-sector partnerships.

As Julie Vallat, VP of Human Rights, L’Oreal reminds us, “we will not achieve anything alone if we are working in isolation on a systemic endemic issue.” This holds true for tackling living wages in value chains, where collaborating at sector level can facilitate social dialogue between suppliers, unions, and workers, and support sector-level collective bargaining agreements. The ACT (Action, Collaboration, Transformation) initiative in the garment sector is a good example.

To have the desired impact of improving workers’ well-being, living wages must be implemented in the context of human rights, decent work, and other social support. Cross-sectoral collaborations are needed to advocate for policy reforms and market incentives, improve supply chain transparency, and develop consistent data collection and reporting mechanisms that do not place too high a burden on suppliers.

Businesses, investors and governments can help move the dial.

Companies can take the next step on their living wages journey. There are a wide variety of proven tools and experienced organisations available to help kick start the journey to paying living wages.

Investors can engage and challenge investee companies on their living wage positions and policies.

Governments can close the gap between minimum wage and living wage by raising minimum wages and supporting collective bargaining as the best wage-setting mechanism for employers and workers.

Above all, as authors of the report we are calling for a mindset shift, whereby living wages are no longer viewed as a cost to business, but as an opportunity to invest in business success. In our view, business leaders need to ask themselves – can I afford not to embrace living wages as a foundation of my business strategy?

Editor’s Note:

Click to download The case for living wages: How paying living wages improves business performance and tackles poverty.

This in-depth report provides

- an overview of the need for living wages;

- the main benefits of living wages to business, drawing from academic literature and real-life examples;

- key questions and resources to support businesses and investors on their own living wages journey.