Having a bank account and access to banking services such as saving and borrowing is taken for granted in middle and high income countries. These services are not available in large parts of Africa, where millions of people continue to be excluded from the banking system. Kenya’s Equity Bank is helping to bridge this gap.

Equity Bank was established in 1982 as a building society to serve the unbanked and to provide products and services that economically empower its customers. Equity Bank’s vision is to champion the social economic prosperity of the people of Africa while its purpose is to transform the lives and livelihoods of the people socially and economically by availing them modern, inclusive financial services that maximize their opportunities

Equity Bank opens around 3,000 new accounts each day and is now the largest bank in Africa in terms of customer base with over 8m account holders in Kenya, Uganda, Tanzania, Rwanda and South Sudan. The company is also one of Kenya’s largest corporate tax payers and is listed on the Kenyan stock exchange.

Equity Bank’s success is rooted in its focus on market need and it is widely considered to be a global leader in microfinance. The loan products include a diverse range and are targeted to specific needs including SME loans, microfinance and agribusiness loans.

Equity Bank has been able to grow profitably due to the large volumes of business services provided through its expanding branch network. It has won numerous awards for innovation and service delivery including Most Innovative Bank in Africa Award at the 2012 African Bankers Awards and 2012 Best Managed Company in Africa award by Euromoney magazine.

TECHNOLOGY AND INNOVATION

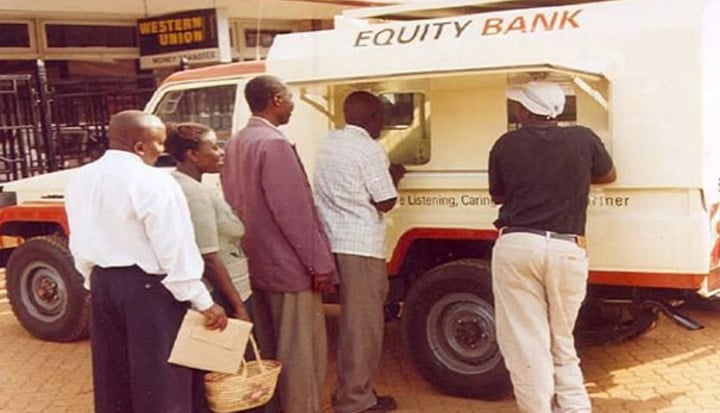

Technology as well as product innovation and delivery are key to Equity Bank business model. Millions of ruralcustomers are provided with access to banking services through “Eazzy Banking”, a mobile phone based service which allows customers to make a range of basic transactions such as balance enquiries, transfers to nominated equity bank accounts and bill payment without having to go to a branch. Full service banking is made available to rural communities through a fleet of 50 mobile banking vans which regularly travel to remote areas. Equity Bank Group recently launched a partnership with Google to introduce BebaPay into the market – a payment card which will provide a quick and convenient way to pay for bus fare.

PARTNERS

Kenya Cooperative Creameries to provide loans to farmers for the purchase of quality dairy cattle to help improve milk yields. Loans are repaid with proceeds from guaranteed forecast milk sales committed with Kenyan cooperative creameries.

The United Nations Development Programme (UNDP) to promote women in business and to develop loans suited specifically to the needs of women entrepreneurs.

INVESTMENT DATA

|

Investee Company |

Equity Bank |

|

Fund |

Helios Investors |

|

Fund Manager |

Helios Investment Partners |

|

CDC Commitment |

US$50m |

|

Date of Commitment |

2006 |

|

Location |

Kenya |